After a recent chat with a work colleague who does a bit of wheeling and dealing on the stock markets he convinced me that maybe I should invest some money in shares. As the UK is coming out of recession it would be a good time to invest. As always there is still a risk of losing your money.

Putting my vast knowledge of absolutely no idea in to a plan, I decided to take the plunge with £3,000 we can’t afford from our Mortgage loan.

I started looking at various graphs on how various companies had performed over the years. The better performing companies naturally have the higher prices so I looked into companies with cheap shares of under £0.50 hoping they will pick up over time. It seems this approach is high risk so I needed an affordable and safer way to invest. Then I came across investment funds.

An investment fund is putting money into a fund managers pot along with 1000s of other people. The fund manager is a professional stocks and shares analyst who invests the money to get a good return. Basically you pay him a yearly fee to trade in stocks and shares. This is the same as pension funds and endowment mortgages are managed. We lost a lot of value on our mortgage endowment policy through the 90’s so I’m aware of the risks. Ironically It is the compensation we got for the failed endowment mortgage that is being used to fund this investment. Will it work this time round???? We will find out in 5 years. (November 2018)

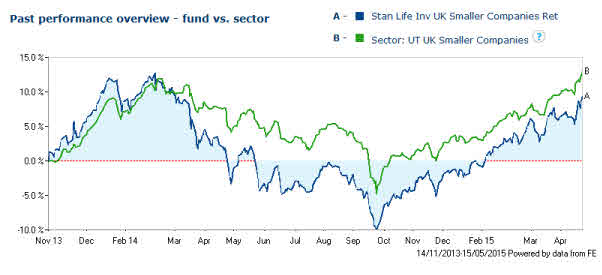

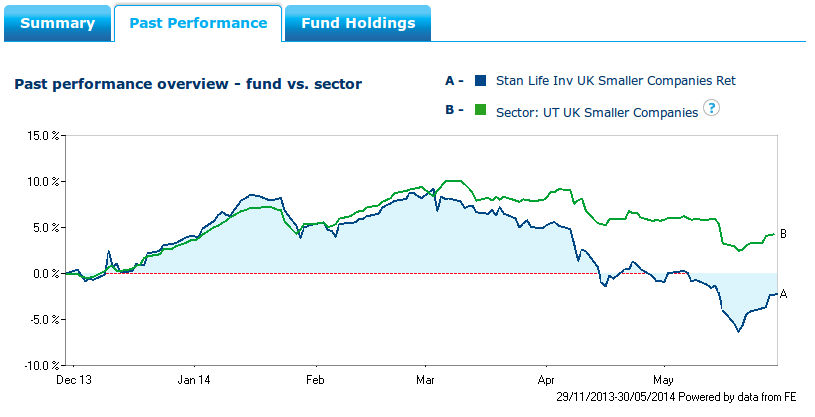

I looked at various investment funds available through UK banks and compared lots a graphs showing how the funds had performed over the years. Some where a gradual climb Granny could handle, some needed mountaineering equipment followed by a parachute, others just needed a set of ski’s. In the end I found a hiking hill. With my very limited knowledge went for a fund that I though would be profitable. Standard Life UK smaller companies. My thinking is if the UK is building up after a recession then smaller companies will gain well baring any issues with the Euro or USA defaulting again on their loan.

So with the accuracy of a blindfolded darts player who had been spun round I set up my account and opted for the chosen investment fund.

I got a starting price of £4.275 for 701 units. As the £3000 i have borrowed will incur an interest charge I need to make more than 32% over 5 years to break even. Anything above my target of £5.65 will pay some of the loan off.

Day 1: I eagerly check the funds progress during my lunch break. A 3.6p loss, looks like I will be trading my hiking boots for ski’s. Thankfully by the end of the day I was up 1p on my initial price. Go Granny go!

Week 1: Yes! I made a loss, well other than the fee’s, 0.5 pence down on the initial price.

Week 2: Up 5 pence, hours of looking at graphs and data looks like it is paying off. In the grand scheme of things I have got out the Garden gate without catching my coat on the latch for the big journey ahead.

3 Months: It’s been 3 month now. The shares started off steady and quickly built up to £320 profit just after Christmas but soon after that the value dropped back to £200. Since Christmas to the middle February the price has steadily increased to £247 profit.